How to Get a Copy of a Trust in California

When a parent passes away after creating a revocable living trust, their children may wonder how to obtain a copy of the trust documents. This is even more common if the trustee is not communicating with the beneficiaries about the trust administration. Here is a step-by-step guide on how to get a copy of a trust in California.

Is a Trustee Required to Provide a Copy of the Trust?

According to California law, a successor trustee must send a notice to all beneficiaries and heirs within 60 days of the trust creator’s death. This notice must include the following information:

- The identity of the settlor or settlors of the trust and the date of execution of the trust instrument.

- The name, address, and telephone number of each trustee of the trust.

- The address of the physical location where the principal place of administration of the trust is located.

- Any additional information that may be expressly required by the terms of the trust instrument.

- A notification that the recipient is entitled, upon reasonable request to the trustee, to receive from the trustee a true and complete copy of the terms of the trust.

A trustee who refuses to send the beneficiary a complete copy of the trust risks facing legal action. The beneficiary can petition the court to compel the trustee to provide a copy of the trust. They can also petition to remove the current trustee.

Probate Code §16061.9 explains that a trustee who fails to send the required notices may even be financially responsible for any resulting legal fees. It states: “A trustee who fails to serve the notification by trustee as required by Section 16061.7 on a beneficiary shall be responsible for all damages, attorney’s fees, and costs caused by the failure unless the trustee makes a reasonably diligent effort to comply with that section.”

Who is Entitled to a Copy of the Trust?

The individuals who are entitled to a copy of the trust include anyone listed in the trust as a trust beneficiary. It also includes the settlor’s heirs, meaning family members who would be entitled to inherit if no will or trust were present. Heirs may include spouses, natural or adopted children, grandchildren, siblings, parents, and nieces and nephews.

Friends, neighbors, romantic partners, and in-laws are not heirs at law and do not have a right to request a copy of the trust unless they are also listed as beneficiaries in the trust.

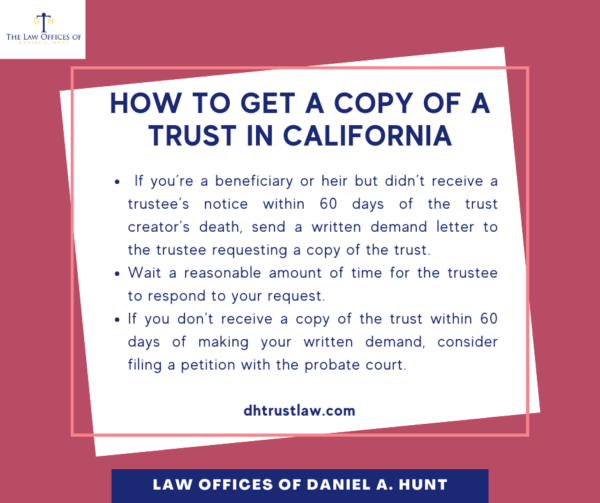

How to Request a Copy of a Trust

In California, there are three steps to requesting a copy of trust documents:

- Send a written demand letter to the trustee requesting a copy of the trust and any amendments that may exist.

- Wait a reasonable amount of time for the trustee to respond to your request.

- If you do not receive a copy of the trust within 60 days of making your written demand, you may consider filing a petition with the probate court requesting that they order the trustee to provide you with a copy of the document.

How to Write a Demand Letter

If you wish to write a demand letter to the trustee, consider using the following language as a template:

Dear [NAME],

As trustee of [decedent]’s trust, California Probate Code Section 16061.7 requires you to send notice within 60 days of [decedent]’s passing to all beneficiaries and heirs regarding the trust administration.

This notice must include the following information:

- The identity of the settlor or settlors of the trust and the date of execution of the trust instrument.

- The name, address, and telephone number of each trustee of the trust.

- The address of the physical location where the principal place of administration of the trust is located.

- Any additional information that may be expressly required by the terms of the trust instrument.

- A notification that the recipient is entitled, upon reasonable request to the trustee, to receive from the trustee a true and complete copy of the terms of the trust.

I have not yet received this notice. But since 60 days have now passed since [decedent]’s passing, I request a true copy of the trust, along with any amendments.

If you do not provide me with the requested documents, I intend to file a petition in the Probate Court requesting the court to order you to provide them to me. If this becomes necessary, I will request that the court order you to pay for the attorneys’ fees and costs associated with my petition, per Probate Code §16061.9.

However, I hope that this will not be necessary and that you will simply provide me as an heir and/or beneficiary with a true copy of the trust and any amendments on or before [DATE].

Sincerely,

[Your Name]

What If You Don’t Know Who The Trustee Is?

Sometimes you don’t know who the trustee is. Maybe your loved one didn’t tell you any specifics about their estate plan, nor did they share a copy of it with you while they were alive. If you know they created a trust, see if you can track down the name of the attorney who prepared it.

Attorneys are required to keep a copy on file of the estate planning documents they prepare for clients. You can try reaching out to the attorney for more information about the trust. Be prepared to provide information such as the decedent’s name, the name of the trust, and the date it was created.

Seek Legal Counsel

If you send a demand letter to the trustee and after 60 days, they still have not sent you a copy of the trust, you should consult an experienced trust litigation attorney for help filing a petition with the Probate Court.

If you have any questions about how to get a copy of a trust in California, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.